1oz Gold Coins

1oz gold coins are available in 3-5 working days. 1oz gold coins typically contain one troy ounce of gold - equivalent to 31.1 grams. Numerous popular gold coins weigh 1oz, including the Britannia, Tudor Beasts and Queen's Beasts from The Royal Mint, the American Gold Eagle and American Buffalo from the US Mint and the Krugerrand from the South African Mint.

You may notice that these 1oz gold coins include a face value on the obverse (front) of the 1oz gold coin. However, the gold content is far more valuable than the face value.

Our friendly team of experts are on-hand to help you protect your wealth with 1oz gold coins. You can simply call us on 0207 058 4653. Alternatively, click on any of the 1oz gold coins below for full details.

2022 1oz 24k Gold Kangaroo

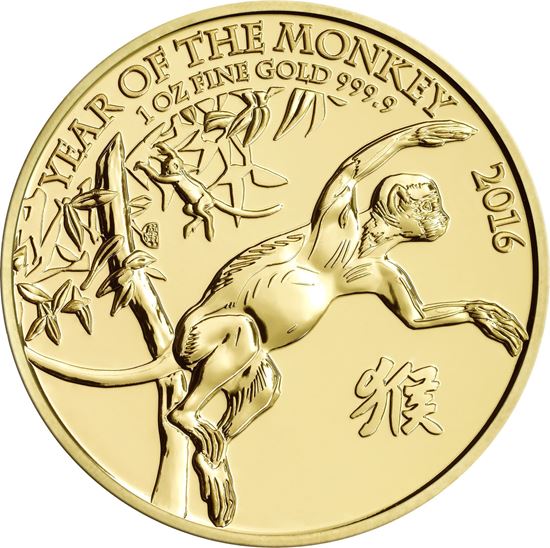

2016 1oz 24k Gold Australian 'Year of the Monkey'

2018 1oz 24k Gold Australian Dragon and the Phoenix

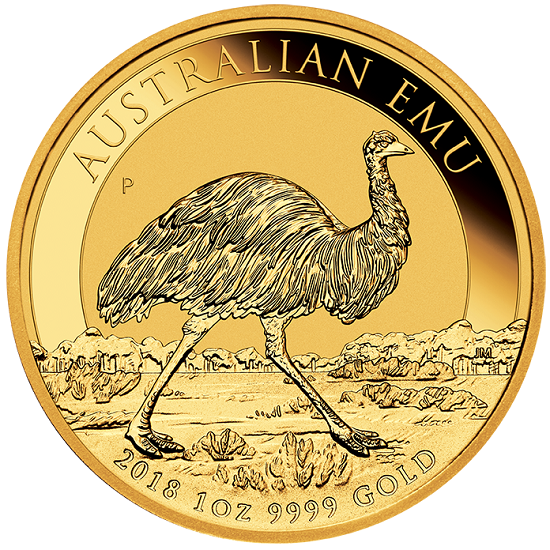

2018 1oz 24k Gold Australian Emu

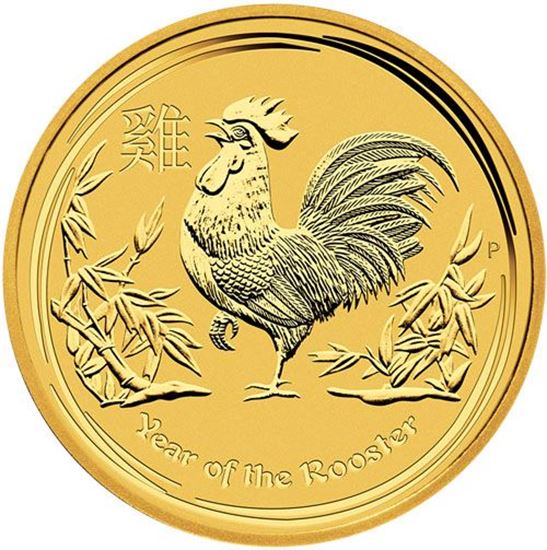

2017 1oz 24k Gold Australian 'Year Of The Rooster'

2018 1oz 24k Gold Australian 'Year Of The Dog'

2019 1oz 24k Gold Australian 'Year Of The Pig'

2021 1oz 24k Gold Australian 'Year Of The Ox'

2022 1oz 24k Gold Australian 'Year Of The Tiger'

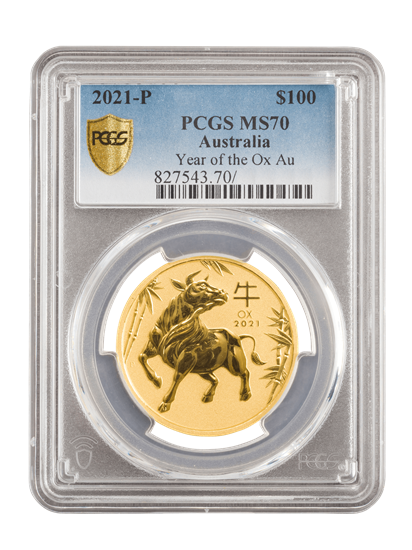

PCGS 2021 1oz 24k Gold Australian 'Year Of The Ox' MS69

PCGS 2021 1oz 24k Gold Australian 'Year Of The Ox' MS70

2019 1oz Gold Australian Dragon

Why so many people buy 1oz gold coins from Direct Bullion

People choose to buy their 1oz gold coins from Direct Bullion because we are the only bullion supplier to meet all 4 critical requirements:

1. Rated UK’s No.1*

We are proud to be rated the UK’s No.1 Bullion Dealer from the respected Bullion Directory. In addition, we have won multiple awards for service excellence and are independently rated at 4.8 out of 5.

2. Smooth, secure delivery

For your complete peace of mind, all items are fully-insured for delivery and with door to door tracking. All items are delivered by reputable courier companies giving you confidence every step of the way.

3. Expert information

You have unlimited access to our friendly specialists who are on-hand to answer any questions you may have to help maximise your results and achieve your objectives.

4. Ongoing support

You will be assigned your own personal gold specialist who will work for you to keep you up to date with your gold, its growth and the financial markets. You will also receive a complimentary subscription to our exclusive publication, InFocus (worth £299 per year).

This combination - only from Direct Bullion - has led to a long-standing reputation for integrity, professionalism and care, which has cemented the Direct Bullion position as one of the world’s go-to services for purchasing 1oz gold coins.

Our team of gold experts are on-hand to help you every step of the way in your purchase of 1oz gold coins. You can simply call them on 0800 055 7050. Naturally, you can also purchase any of the above 1oz gold coins from our secure website.

About 1oz Gold Coins

1oz gold coins have a legal tender status and are produced by The Royal Mint. 1oz gold coins feature a face value and year stamped on the obverse (or front), with their purity and weight inscribed on the reverse (or back).

1oz gold coins typically sell at a slightly higher price than the metal’s spot price. This is commonly due to their collectability, status as legal tender, rarity and the work involved in minting the coin. This price difference is known as the ‘premium’ and when gold is popular, the premiums often increase too.

As a result, people who choose to protect their wealth with 1oz gold coins are able to make money in two ways - firstly from the natural rise in gold prices, and secondly through the increase in the premium.

There are two main types of 1oz gold coins - loose 1oz gold coins and graded gold coins - both types are shown above. Graded 1oz gold coins have a protective case which keeps the coin in it's graded condition. As a reputable bullion dealer, Direct Bullion are an authorised dealer of the PCGS (Professional Coin Grading Service).

Why Gold Increases in Value

Gold has increased in value by an average 12.5% per year from 2005-22 (Source: Goldprice).

There are many factors that drive the price with each individual factor able to propel the value of gold upwards by itself. Yet often, these factors work at the same time to drive even further growth.

- Interest Rates

Gold can benefit from both lower and higher interest rates. Lower interest rates suggest a weaker economy, which can turn people away from stocks and shares and towards gold.

Meanwhile higher interest rates can lead to more mortgage defaults, etc. which can push people towards gold as a form of wealth insurance.

- Inflation

As goods and services become more expensive, your cash buys less and less. As a result, if your earnings and investments are not keeping up with inflation then unfortunately you will be getting poorer.

As inflation damages the value of cash, many people are inspired to move their wealth into gold for added protection.

- Uncertainty

At times of national or international uncertainty (created by the political, social, economic, etc. situation), people naturally want to reduce their risk and protect what they have.

As gold is considered a safe-haven asset, this uncertainty can increase the demand for gold, and therefore increase its price.

- Supply

Gold is a finite resource. When compared to the 19702, 80s, and 90s, far fewer 50+ million, 30+ million or 15+ million ounce gold deposits are now being found, with mining production having levelled since 2016 (source: Investopedia).

This decrease in gold supply can then lead to higher gold prices.

- Currency Movements

The price of gold is dollar denominated. As a rule, when the dollar is weaker, relative to other currencies worldwide, the price of gold tends to increase in US dollar terms. This is because people want to move their wealth away from the dollars and into gold.

- Versatility of Gold

Gold has many uses beyond becoming coins or bars - the jewellery market accounted for 55.4% of the global gold demand in 2022.

The gold jewellery material segment is projected to register the fastest growth of the entire jewellery market from 2022 to 2030 (Source: Statista). This strong demand for gold can then contribute to the overall increase in gold prices.

These factors can significant increase the value of your 1oz gold coins over time.

The Tax-Free Benefits of 1oz Gold Coins

One of the reasons why 1oz gold coins are so popular is that they can provide numerous tax benefits.

- 22k and 24k gold coins are VAT-free, enabling you to protect more of your wealth with gold

- All 1oz gold coins supplied by Direct Bullion are VAT-free

- 1oz gold coins are Capital Gains Tax-free to UK residents so you keep all the profits from your smart decision

These tax benefits exist because 1oz gold coins are regarded as legal tender and are viewed as a form of currency. If you were to present a 1oz gold coin to the bank, the coin would be classed as being worth its face value, e.g. £100, rather than its retail value.

With 1oz gold coins, obviously the metal content is more valuable than the face value - this is the complete opposite of the standard-issue £2, £1, 50p, 20p, 5p, 2p and 1p coins where the metal value is miniscule (even less than their face value).

Download our Guide to Tax-Free Gold

Gain smart insights and exclusive content so you can discover how to seize back control of your wealth and future.

- Packed with information you won’t get anywhere else.

- The secrets of why your wealth is disappearing.

- The meteoric growth that gold has enjoyed in critical dates.

- Why gold outperforms other assets you may have.

Call 0800 055 7050 or add your info below to immediately be emailed your copy - for free. Your data will never be sold.

Download our Guide to Tax-Free Gold

Gain smart insights and exclusive content so you can discover how to seize back control of your wealth and future.

- Packed with information you won’t get anywhere else.

- The secrets of why your wealth is disappearing.

- The meteoric growth that gold has enjoyed in critical dates.

- Why gold outperforms other assets you may have.

Call 0800 055 7050 or add your info below to immediately be emailed your copy - for free. Your data will never be sold.